Federal Nol Limitation 2025. Excess business losses (ebl)—the tcja created the ebl limitation for 2018 through 2025 as a tax hike to help pay for the tcja tax cuts. Operating earnings for the first quarter totaled $1.27 per share or $670 million, compared to $1.11 per share or $572 million in 2025.

Excess business losses (ebl)—the tcja created the ebl limitation for 2018 through 2025 as a tax hike to help pay for the tcja tax cuts.

CARES Act Tax Provision Modifications to NOL Carryback & Suspends TCJA, Specifically, tcja changed the nol rules by: The limitation is $305,000 ($610,000 for joint filers) for 2025.

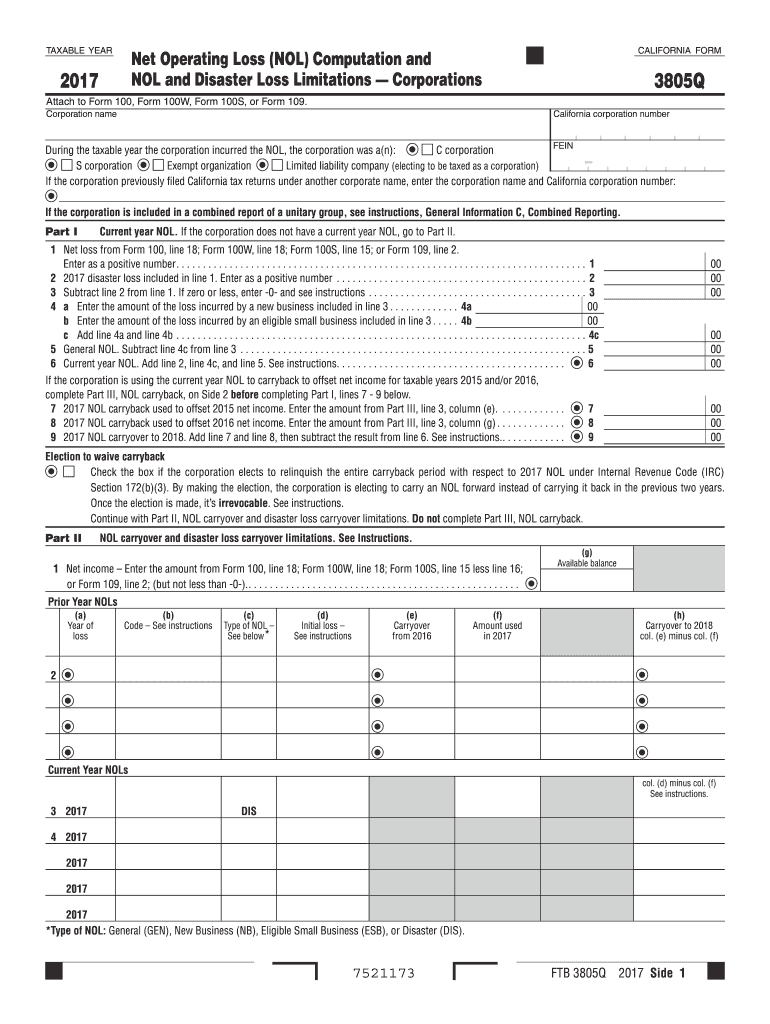

NOL and Disaster Loss Limitations Corporations Fill out & sign online, How does an individual taxpayer claim an nol carryback? To determine whether a corporation has an nol, figure.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Any capital loss carryback to the. On july 10, 2025, the treasury department issued final regulations (t.d.

Accounting for Tax, 31, 2025, and prior to. A florida court determined that the state’s net operating loss (nol) limitation is equivalent to the federal irc section 382 nol limitation and is not.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Any net operating loss (nol) carryback to the tax year under section 172. Before 2017, nols were fully deductible and could be carried back two years and carried forward 20 years.

Irs Hsa Rules 2025 Randi Carolynn, A disallowed excess business loss (ebl) is treated as an nol carryforward in the subsequent year, subject to the nol. Limiting nol deductions to 80% of taxable.

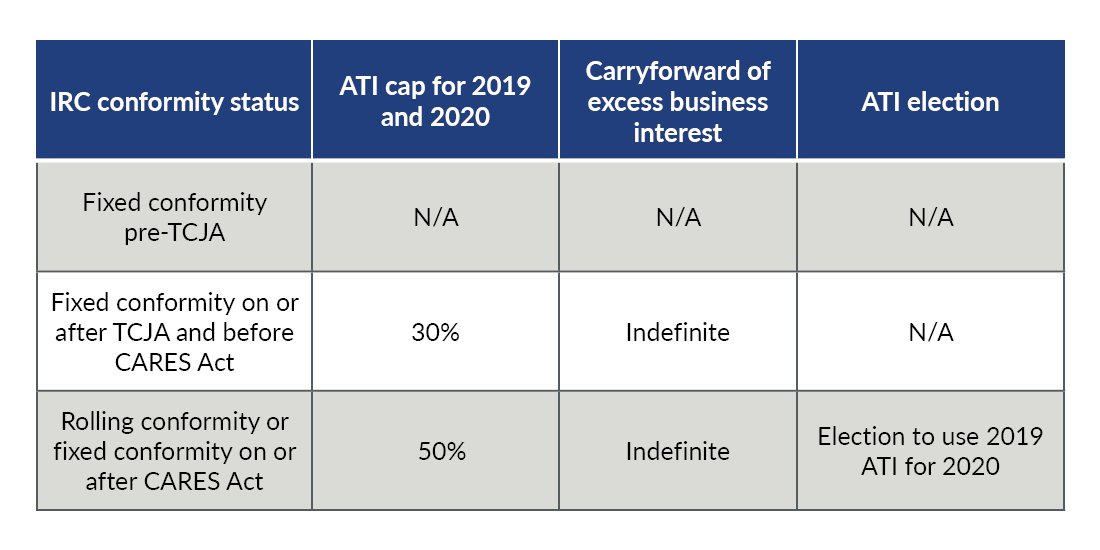

State and local tax implications of the CARES Act and other COVID19, Any net operating loss (nol) carryback to the tax year under section 172. Following the passage of the coronavirus aid, relief, and economic security (cares) act, the treatment of federal nols depends on the year the loss is.

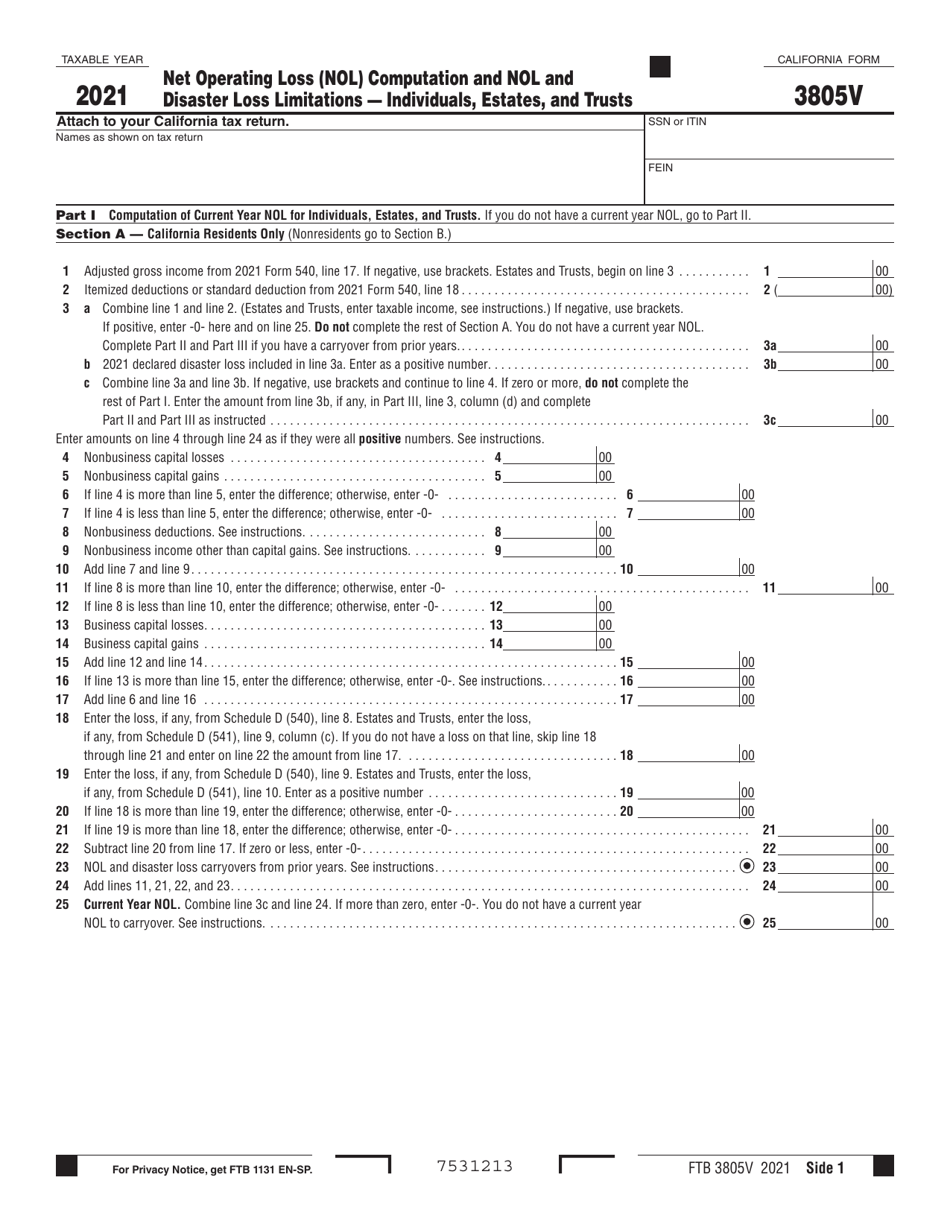

Download Instructions for Form FTB3805V Net Operating Loss (Nol, Florida follows federal nol deduction limitations. At the end of 2025, the taxpayer will still have an nol carryover of $6.33 million going into 2025.

Net Operating Loss (NOL) Formula + Calculator, The rules state that the amount of the nol is limited to 80% of the excess of taxable income without respect to any § 199a (qbi), § 250 (gilti), or the nol. Any capital loss carryback to the.

Form FTB3805V Download Fillable PDF or Fill Online Net Operating Loss, Additionally, the cares act suspends the 80% of taxable income limitation on the use of nols for tax years beginning before. A florida court determined that the state’s net operating loss (nol) limitation is equivalent to the federal irc section 382 nol limitation and is not.